Loading

Get Health Care And Dependent Care Reimbursement Form ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

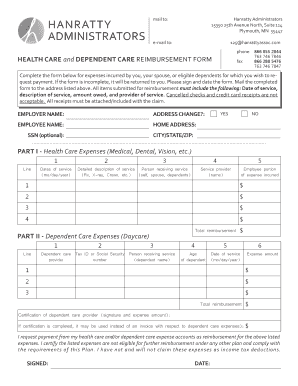

How to fill out the HEALTH CARE And DEPENDENT CARE REIMBURSEMENT FORM online

This guide provides a clear and supportive overview of how to effectively complete the HEALTH CARE and DEPENDENT CARE REIMBURSEMENT FORM online. By following these steps, users can ensure their expenses are accurately documented and submitted for reimbursement.

Follow the steps to complete the form with ease

- Press the ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by filling in the employer name in the designated field. If there is an address change, indicate 'Yes' or 'No' in the provided section.

- Enter the employee name and home address. You can also include your Social Security Number (optional). Ensure to fill in the city, state, and zip code accurately.

- Navigate to Part I for Health Care Expenses. Enter the dates of service using the format month/day/year. Include a detailed description of the service provided, alongside the name of the person receiving the service (yourself, spouse, or dependents).

- Provide the name of the service provider and the employee portion of the expense incurred for each listed item. Repeat this process for all applicable entries.

- Calculate the total reimbursement for health care expenses and input this figure in the provided space.

- Proceed to Part II for Dependent Care Expenses. Fill in the dependent care provider's Tax ID number or Social Security number, alongside the dependent's name.

- List the age of the dependent and the date of service in the same format as before. Document the expense amount for each instance.

- Consolidate the total reimbursement for dependent care expenses and record this amount in the corresponding section.

- If applicable, obtain the certification of the dependent care provider by signing and entering the expense amount. This certification may replace an invoice.

- Finally, review all entries for accuracy, sign and date the form. Save any changes, and prepare to download, print, or share the completed form as needed.

Start completing the HEALTH CARE and DEPENDENT CARE REIMBURSEMENT FORM online today!

Your employer manages your FSA, but the IRS sets the rules. ... You put money into the Dependent Care FSA account pre-tax to pay for things like child care. If you don't use it by a certain date, you lose it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.