Loading

Get Dependent Care Fsa Reimbursement Form - Next Generation ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dependent Care FSA Reimbursement Form - Next Generation online

Filling out the Dependent Care FSA Reimbursement Form correctly is essential for ensuring you receive the eligible reimbursements for your dependent care expenses. This guide will walk you through each section of the form, providing clear instructions and helpful tips to assist you in completing it online.

Follow the steps to complete your reimbursement form efficiently.

- Start by clicking the ‘Get Form’ button to access the form. This will open the Dependent Care FSA Reimbursement Form for you to complete online.

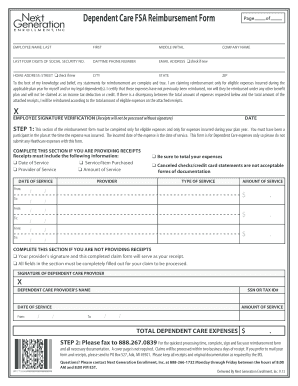

- Fill in your personal information at the top of the form, including your last name, first name, and middle initial. Enter the last four digits of your social security number, your daytime phone number, and your email address. Indicate if you have a new email address by checking the box.

- Complete the home address section with your street address, city, state, and zip code. Similarly, check the box if this is a new address.

- Enter your company name as required on the form.

- In the reimbursement statement section, confirm that you are claiming reimbursement only for eligible expenses incurred during the applicable plan year for yourself and/or your legal dependent(s). Ensure that these expenses have not previously been reimbursed.

- Sign and date the form at the bottom, confirming that all provided information is accurate.

- If you are providing receipts, ensure that they include the date of service, service/item purchased, provider of service, and the amount of service. List each expense, ensuring to total your submissions. Remember, canceled checks or credit card statements are not accepted.

- If not providing receipts, have your dependent care provider sign the form. Fill in their name, social security number or tax ID, and the total dependent care expenses.

- Once completed, save your form and prepare it for submission. You can fax it to 888.267.0839 for faster processing, or mail it to PO Box 527, Ada, MI 49301 if you prefer.

Take the next step towards submitting your documentation online for reimbursement.

In general, an FSA will provide a larger tax benefit to those in higher tax brackets. ... In one-dependent families, the FSA allows up to $5,000 in eligible expenses, whereas the tax credit is limited to $3,000. When there are two or more dependents, the credit allows $6,000 versus $5,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.