Loading

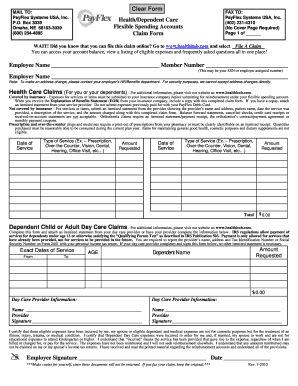

Get Health/dependent Care Flexible Spending Accounts Claim Form ... - Princeton

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health/Dependent Care Flexible Spending Accounts Claim Form online

Completing the Health/Dependent Care Flexible Spending Accounts Claim Form is essential for managing your eligible expenses effectively. This guide provides step-by-step instructions to help you navigate and fill out the form accurately to ensure a seamless reimbursement process.

Follow the steps to successfully complete your claim form.

- Press the 'Get Form' button to obtain the form and open it in your document editor.

- Begin by filling in your employee name and member number at the top of the form. This can include your Social Security Number or your employer-assigned number.

- Next, enter your employer's name. If you need to make any address changes, be sure to contact your employer’s HR or benefits department, as address changes cannot be accepted directly.

- For health care claims, indicate whether the expenses were covered by insurance. If they were, attach the Explanation of Benefits Statement (EOB) you received from your insurance company.

- For expenses not covered by insurance, include an itemized statement from your provider. This statement should include the provider’s name and address, your name, the date when the service was provided, a description of the service, and the amount charged. Be aware that certain documents like balance forward statements or credit card receipts are not acceptable.

- Complete the fields for each service you are claiming, including the date of service, the type of service (e.g., prescription, vision, dental), and the amount requested.

- For dependent child or adult day care claims, fill out the exact dates of service and the name of your dependent. You must attach an itemized statement from your day care provider or have them complete the relevant section on the form.

- Certify the expenses by signing the designated area on the form. This confirms that the submitted expenses were incurred and that you will not seek reimbursement from other sources.

- Ensure that you have made copies for your records since your submitted documents will not be returned. If you choose to fax your claim, keep the original form for your records.

- Finally, you can save changes, download, print, or share the completed form as needed.

Start filling out your Health/Dependent Care Flexible Spending Accounts Claim Form online today to manage your expenses effectively.

Check account balances. Submit claims and view claims status. Look up eligible expenses. Select your reimbursement methods (by check or direct deposit) Choose to receive account alerts by email or text.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.