Loading

Get New Employee Payroll Setup Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New Employee Payroll Setup Form online

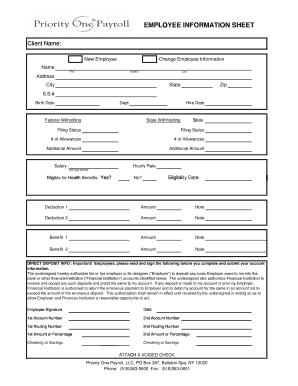

Filling out the New Employee Payroll Setup Form online is a crucial step in ensuring your payroll information is accurate and complete. This guide provides clear, step-by-step instructions to help you navigate the form effectively.

Follow the steps to accurately complete your payroll setup.

- Click ‘Get Form’ button to access the New Employee Payroll Setup Form and open it in your preferred editor.

- Begin by entering your personal information. Fill in your first, middle initial, and last name in the designated fields.

- Provide your address by entering the city, state, and zip code in the respective fields.

- Enter your Social Security number and birth date in the specified areas.

- Specify your department and hire date in the appropriate fields.

- Complete the federal and state withholding sections. Select your filing status and enter the number of allowances you are claiming.

- If applicable, indicate any additional withholding amount in the provided field.

- Fill in your salary or hourly rate and the pay period frequency in the respective sections.

- Indicate your eligibility for health benefits by selecting 'Yes' or 'No' and provide the eligibility date if applicable.

- Fill in the deduction and benefit sections by providing the amounts and notes for each deduction and benefit you wish to include.

- Complete the direct deposit information section by authorizing your employer to deposit wages in your bank account. Enter the account numbers, routing numbers, and whether the account is checking or savings.

- Attach a voided check to ensure accurate banking information.

- Sign and date the form to authorize your employer to process this information.

- Once all sections are filled out, review the information for completeness and accuracy. You can then save your changes, download, print, or share the form as needed.

Ensure your payroll is set up correctly by completing the New Employee Payroll Setup Form online.

A payroll deduction plan refers to when an employer withholds money from an employee's paycheck for a variety of purposes, but most commonly for benefits. ... One common example of an involuntary payroll deduction plan is when an employer is required by law to withhold money for Social Security and Medicare.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.