Loading

Get Stancera Retiree Tax Withholding Election Form W4 ... - Stancera

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the StanCERA retiree tax withholding election form W4 online

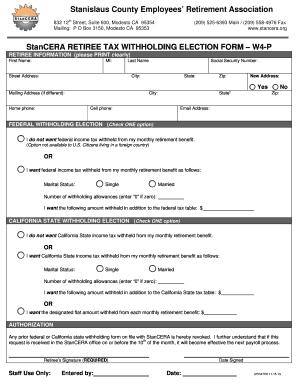

Completing the StanCERA retiree tax withholding election form W4 is crucial for ensuring your retirement benefits align with your tax preferences. This guide provides clear and supportive steps to help you fill out the form accurately online.

Follow the steps to complete your tax withholding election form.

- Click the ‘Get Form’ button to access the form and open it for completion.

- In the retiree information section, print clearly and fill in your first name, middle initial, last name, social security number, street address, city, state, and zip code.

- If you have a new address, indicate 'Yes' or 'No' by marking the corresponding box. If your mailing address differs from your home address, complete the section for the mailing address as well.

- Provide your home and cell phone numbers, along with your email address for contact purposes.

- Proceed to the federal withholding election section. Select one option: either indicating that you do not want federal income tax withheld or that you do want it withheld. If withholding is desired, provide your marital status, the number of withholding allowances, and any additional amount you wish to have withheld.

- Next, complete the California state withholding election section. Again, select one option regarding your desire for state income tax withholding and provide the required details if you wish to withhold.

- In the authorization section, acknowledge that any prior withholding forms are revoked. Sign and date the form where indicated to validate your submission.

- Review all filled areas for accuracy. You can then save any changes made, download the form, print a copy, or share it as needed.

Take action now to complete your StanCERA retiree tax withholding election form online!

Pension recipients can make a withholding change by filling out Form W-4P, available on IRS.gov, and giving it to their payer. This form is similar to the more familiar Form W-4 that employees give to their employers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.