Loading

Get Arizona Inheritance Tax Waiver Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Inheritance Tax Waiver Form online

Completing the Arizona Inheritance Tax Waiver Form online is an essential step in managing estate-related tax obligations. This guide aims to provide clear, step-by-step instructions to help you navigate the process with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the Arizona Inheritance Tax Waiver Form and open it in your preferred online editor.

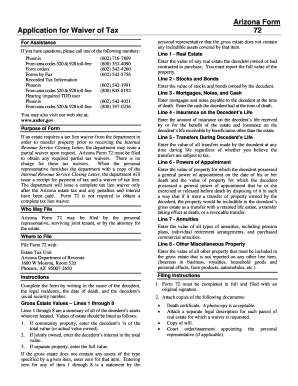

- Begin filling out the form by providing essential information such as the name of the person who has passed away (the decedent), their legal residence, the date of death, and the decedent’s social security number.

- In Lines 1 through 8, report the values of the decedent’s gross estate assets. For each line, provide the following: 1. Real estate value (report full value). 2. Stocks and bonds owned by the decedent. 3. Mortgages, notes, and cash amounts the decedent had at death. 4. Insurance amounts receivable by the estate or beneficiaries. 5. Value of any transfers made by the decedent during their lifetime. 6. Include properties where the decedent had a power of appointment. 7. Report all annuity values. 8. Any other miscellaneous property that must be included.

- If a particular line does not apply, enter zero for that line item as a declaration that there are no such assets.

- Ensure the form is completed in full and sign it with an original signature.

- Attach required documents, including a death certificate, a legal description of real estate for which a waiver is requested, a copy of the will, and any relevant court orders or statements appointing the personal representative.

- Once all information is filled out and documents are attached, save the form. You can also download, print, or share it as needed.

Complete your Arizona Inheritance Tax Waiver Form online today for a smooth estate management experience.

Arizona, Not required. ... The following list of state agencies that issue inheritance tax waivers and their ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.