Loading

Get Form Ir37

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ir37 online

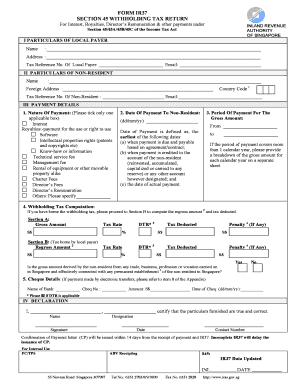

Filling out the Form Ir37 is a crucial step for reporting withholding tax returns for various payments specified under the Income Tax Act. This guide will provide you with clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the Form Ir37.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In Section I, enter the particulars of the local payer, including the name, address, tax reference number, and email address.

- Proceed to Section II to fill out the particulars of the non-resident, specifying their name, foreign address, country code, tax reference number, and email address.

- In Section III, detail the payment information. Indicate the nature of the payment by ticking the appropriate box, and provide the date of payment along with the period of payment for the gross amount.

- Complete the withholding tax computation in Section III. Enter the gross amount, applicable DTR, tax rate, and calculated tax amount in the specified fields.

- If the local payer bore the tax, proceed to Section B to compute the regross amount and tax deducted, and fill in the corresponding fields.

- Provide cheque details in Section III, including the bank's name, cheque number, amount, and date of the cheque.

- In Section IV, the certification must be completed, including the name of the certifying individual, their signature, designation, date, and contact number.

- Once all sections have been filled out correctly, save your changes, and consider downloading, printing, or sharing the completed form as needed.

Complete your Form Ir37 online today to ensure timely processing and compliance with tax regulations.

Employers generally must withhold federal income tax from employees' wages. To figure out how much tax to withhold, use the employee's Form W-4, Employee's Withholding Certificate, the appropriate method and the appropriate withholding table described in Publication 15-T, Federal Income Tax Withholding Methods.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.