Loading

Get Neft Rtgs Payoutrequest Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Neft Rtgs Payoutrequest Form online

Completing the Neft Rtgs Payoutrequest Form online can streamline your payout requests efficiently. This guide provides step-by-step instructions to ensure you fill out the form correctly and understand each component.

Follow the steps to fill out the Neft Rtgs Payoutrequest Form accurately.

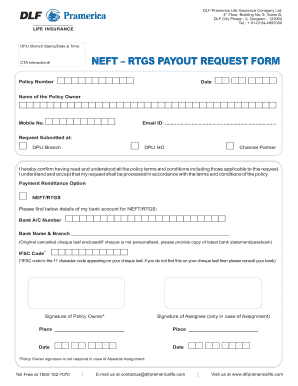

- Press the 'Get Form' button to access the form online.

- Fill in the policy number in the designated field. This number is essential for identifying your specific policy.

- Enter the date using the format DD MM YYYY to specify when you are submitting the request.

- Provide the name of the policy owner. Ensure the name matches the one on record.

- Input a mobile number where you can be reached for any queries regarding your request.

- Fill in your email ID accurately as it may be used for communication about your request.

- Indicate where the request is submitted, selecting between DPLI branch, DPLI HO, or channel partner.

- Read the confirmation statement regarding your understanding of the policy terms, and check the box to confirm.

- Select your preferred payment remittance option by choosing either NEFT or RTGS.

- Provide the details of your bank account including bank account number and bank name & branch. Ensure accuracy to avoid processing delays.

- Enter the IFSC code from your cheque leaf or bank statement; ensure it is correct to facilitate the transaction.

- Sign the form as the policy owner. If there is an assignee, their signature is also required.

- Provide the place where you are signing the form and the date in the specified format.

- Once completed, review all sections for accuracy before saving your changes. You can then download, print, or share the form as necessary.

Complete the Neft Rtgs Payoutrequest Form online today for a smooth payment process.

The fundamental difference between RTGS and NEFT, is that while RTGS is based on gross settlement, NEFT is based on net-settlement. Gross settlement is where a transaction is completed on a one-to-one basis without bunching with other transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.