Loading

Get I Have Made A Gift Of $

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the I Have Made A Gift Of $ online

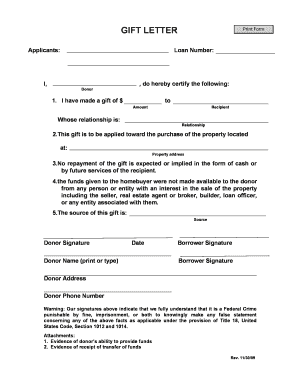

Filling out the I Have Made A Gift Of $ form is an important process for documenting financial gifts used in property purchases. This guide will provide you with clear and supportive instructions to complete the form effectively online.

Follow the steps to fill out the gift form correctly.

- Click the ‘Get Form’ button to access the form and open it in your online editor.

- In the first section, indicate the exact amount of the gift in dollars. Enter this information in the designated field labeled 'I have made a gift of $'.

- Next, specify the relationship between the donor and recipient in the section labeled 'Whose relationship is:'. Clearly state how the individuals are connected.

- Under the property information section, provide the complete address of the property intended to be purchased using the gift funds in the field titled 'This gift is to be applied toward the purchase of the property located at:'.

- Confirm that no repayment of the gift is expected or implied by selecting 'No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.'

- In the next field, indicate that the funds were not provided to the donor from any person or entity with an interest in the sale of the property by confirming 'The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property...'.

- Document the source of the gift in the field labeled 'The source of this gift is:'. Ensure that this is clearly noted.

- After filling in all the necessary information, don’t forget to sign and date the form in the appropriate sections for both the donor and the borrower, confirming the accuracy of the information provided.

- Finally, be sure to save all changes to your filled-out form. You can then download, print, or share it as needed.

Complete your gift forms online now for a seamless documentation process.

The annual gift tax exclusion for 2020 will be $15,000 (the same as it was for 2019). That number may rise in the future as inflation impacts the value of the U.S. dollar. The annual gift tax applies to each individual person you give a gift to.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.