Loading

Get Transfer Form 504allt11 - Ally

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

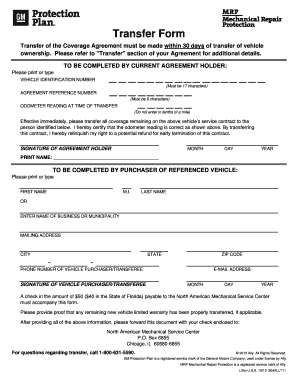

How to fill out the Transfer Form 504ALLT11 - Ally online

This guide provides detailed instructions for completing the Transfer Form 504ALLT11 - Ally online. Following these steps will help ensure that you complete the form accurately and efficiently.

Follow the steps to effectively fill out the Transfer Form 504ALLT11 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the vehicle identification number, ensuring it is exactly 17 characters long. This number uniquely identifies your vehicle.

- Next, enter the agreement reference number, which must be exactly 9 characters. This number relates to your service agreement.

- Provide the odometer reading at the time of transfer. Ensure that you do not include tenths of a mile in your entry.

- Certify the odometer reading by signing your name as the current agreement holder. Include the date of transfer by filling in month, day, and year.

- Print your name clearly below your signature to confirm your identity.

- Switch to the purchaser section of the form. Enter the first name, middle initial, and last name of the new vehicle owner. If applicable, you may also enter the name of a business or municipality.

- Fill in the mailing address, including the state, city, and zip code. Ensure that all information is typed or printed clearly.

- Include the phone number and email address of the vehicle purchaser or transferee.

- The vehicle purchaser must sign the form and also provide the date by filling in month, day, and year alongside their signature.

- Be aware that a payment of $50 (or $40 in Florida) must accompany this form. Ensure the check is made payable to the North American Mechanical Service Center.

- If applicable, provide proof of any remaining new vehicle limited warranty transfer.

- Finally, forward the completed form along with the payment check to the specified address: North American Mechanical Service Center, P.O. Box 6855, Chicago, IL 60680-6855.

Start filling out your Transfer Form 504ALLT11 online today!

Communications: This is a broad category that could encompass all expenses related to communication, including telephone, internet, and postage. Telephone: This category could specifically cover all expenses related to telephone service, including landlines, mobile phones, and long distance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.