Loading

Get 740v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 740v online

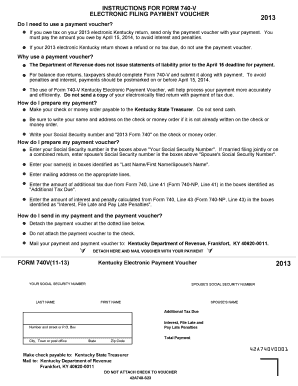

Filling out the 740v online is a straightforward process designed to streamline your payment obligations when filing your electronic tax return. This guide will walk you through each section and field of the form, ensuring you have all the information needed to complete it accurately and efficiently.

Follow the steps to successfully complete the 740v online.

- Press the ‘Get Form’ button to access the payment voucher and open it in your preferred online document editor.

- Fill in your Social Security number in the designated box labeled 'Your Social Security Number.' If you are filing jointly, also enter your spouse's Social Security number in the section labeled 'Spouse's Social Security Number.'

- Enter your name and, if applicable, your spouse’s name in the fields marked 'Last Name/First Name/Spouse's Name.' Ensure all names are accurately spelled and formatted.

- Provide your mailing address, including street number and name or P.O. Box, city or town, state, and zip code in the corresponding fields.

- Indicate the amount of additional tax due as stated on Form 740, Line 41, in the box labeled 'Additional Tax Due.'

- Calculate and enter any interest and penalties for late payment as noted on Form 740, Line 43, in the designated box for 'Interest, File Late and Pay Late Penalties.'

- Detach the payment voucher along the dotted line and ensure it is separate from your payment. Do not attach the voucher to your check.

- Mail your completed payment voucher and check or money order payable to the 'Kentucky State Treasurer' to the Kentucky Department of Revenue at Frankfort, KY 40620-0011.

- After completing all steps, review the form for any errors, save changes, and ensure that you keep a copy for your records.

Complete your 740v form online today to ensure timely and accurate payment processing.

Related links form

Beginning Jan. 1, 2023, the state's income tax is set to drop to 4.5%, and the bill's supporters in the General Assembly have plans to approve additional 0.5% reductions if they deem the state's budget can afford it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.