Loading

Get Form Ar Tx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AR-TX online

This guide provides detailed instructions for completing the Form AR-TX online, ensuring that users are supported throughout the process. With clear steps, you will be able to effectively fill out the necessary information for reporting exempt wages in Arkansas.

Follow the steps to complete the Form AR-TX online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

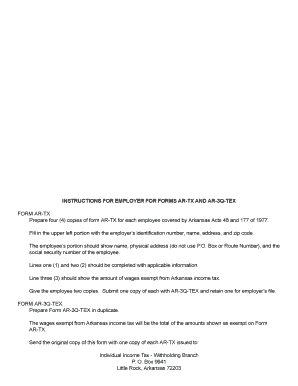

- Begin by filling out the upper left section with your employer identification number, name of the business, address, city, state, and zip code. Ensure all details are accurate to avoid processing issues.

- In the employee section, enter the name and physical address of the employee. Do not use a P.O. Box or Route Number. Include the employee's social security number precisely.

- Complete line one with relevant information regarding the employee's wages, and similarly, fill out line two with any additional applicable details.

- Provide the exempt wages amount on line three. This amount should reflect what qualifies for exemption from Arkansas income tax.

- Once the Form AR-TX is filled out, ensure that you save your changes and download a copy for your records. You may also wish to print the form for physical submission.

- Prepare two copies of Form AR-3Q-TEX. Ensure that the total of wages exempt from Arkansas income tax matches the combined amounts identified on the AR-TX forms.

- Lastly, submit the original copy of the Form AR-3Q-TEX along with one copy of each AR-TX issued to the Individual Income Tax - Withholding Branch at the specified address.

Complete your documents online today for a streamlined filing experience.

In Person: Forms and instructions may be picked up on main floor of the Dean B. Ellis Library, near the newspapers and the Internal Revenue Office, Federal Building, 2nd Floor, 615 South Main, Jonesboro, AR 72401.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.