Loading

Get 71a101 (4-05) Motor Vehicle Usage Tax Multi-purpose Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 71A101 (4-05) MOTOR VEHICLE USAGE TAX MULTI-PURPOSE FORM online

Filling out the 71A101 (4-05) motor vehicle usage tax multi-purpose form online can be straightforward when you follow the proper steps. This guide will assist you in completing each section accurately to ensure successful processing.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the 71A101 (4-05) motor vehicle usage tax multi-purpose form in your online editor.

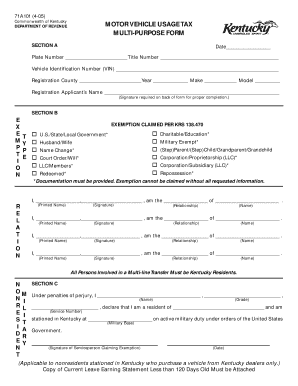

- In Section A, enter the date and fill in the plate number, title number, vehicle identification number (VIN), registration county, year, make, and model of the vehicle. Include the name of the registration applicant, ensuring that the signature is provided on the back of the form for proper completion.

- Move to Section B, where you will indicate any exemption claimed under KRS 138.470 by checking the appropriate box. Remember to provide necessary documentation; exemption cannot be claimed without all requested information.

- Complete the printed name, signature, and relationship fields for all individuals involved in the transaction as outlined in the section. This might include relatives or partners, reflecting people-first language.

- In Section C, if applicable, declare your residency and provide your military information, ensuring to attach a current leave earning statement that is less than 120 days old.

- Proceed to Section D, which pertains to transactions involving modified vehicles. Document any major equipment added and provide necessary documentation such as contracts or bills of sale.

- For Section E, indicate the price without trade or before trade and specify the portion of the price attributable to equipment or adaptive devices for accommodations of people with disabilities.

- Review all sections to ensure accuracy, save changes, and proceed to download, print, or share the completed form.

Complete your documents online for a hassle-free experience!

Sticker shock: Rising used car values mean car tags in Kentucky will be higher in 2022. Due to rising used car values during the pandemic, property taxes on vehicles in Kentucky will be much, much higher this year, local and state officials warn. The state uses a standard valuation to set the value of vehicles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.