Loading

Get Form Ref 1000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ref 1000 online

Filling out the Form Ref 1000 for fuel tax refunds can be a straightforward process when you follow the proper steps. This guide will provide you with clear, user-friendly instructions to complete the form online efficiently.

Follow the steps to complete the Form Ref 1000 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

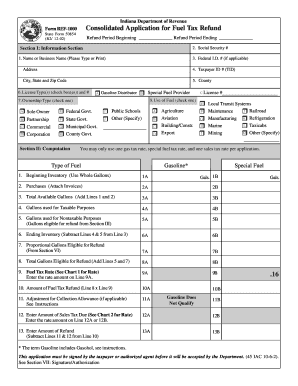

- Provide your personal or business information in Section I. This includes your name, Social Security number, Federal ID number (if applicable), and address details.

- Indicate your Taxpayer ID number and the county related to your business. Mark the appropriate ownership type and license type, as well as the number associated with it.

- In Section II, begin the computation process by entering the beginning inventory of fuel in whole gallons, and record your purchases, attaching any necessary invoices.

- Add the amounts from the inventory and purchases to calculate the total available gallons. Next, input the gallons used for taxable and nontaxable purposes.

- Calculate the ending inventory by subtracting the taxable and nontaxable gallons used from the total available gallons.

- Determine the proportional gallons eligible for refund from Section VI and add these to the nontaxable gallons to find the total gallons eligible for refund.

- Fill in the fuel tax rate based on the applicable chart and calculate the total amount of fuel tax refund by multiplying the total eligible gallons by the tax rate.

- Complete the adjustments for any collection allowance and enter the amount of sales tax due based on the gallons purchased and exempt percentages.

- Finally, calculate the net refund amount by subtracting adjustments from the total refund amount. Ensure that all calculations are accurate.

- In Section VII, provide your signature or that of an authorized agent, along with the required contact information and any necessary attachments.

- Once all fields are completed, you can save changes, download, print, or share the form as needed.

Take action now and complete your fuel tax refund application online.

For every gallon of gas you purchase, you will get $0.025 back. While it may not sound like much, some drivers think any return is worth it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.