Loading

Get Form 990 Public Relations Checklist For 501 (c) - Pennsylvania ... - Pano

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 990 Public Relations Checklist For 501 (c) - Pennsylvania ... - Pano online

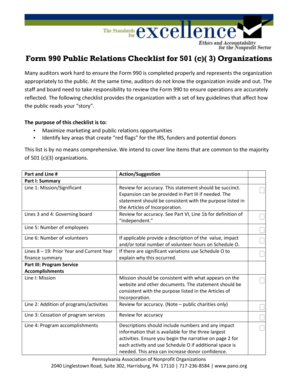

The Form 990 Public Relations Checklist is a vital tool for 501(c)(3) organizations in Pennsylvania, helping ensure that your public representation aligns with your operations. This guide provides clear and supportive instructions, making the filling process straightforward for all users.

Follow the steps to effectively complete the Form 990 Public Relations Checklist online.

- Press the ‘Get Form’ button to obtain the checklist and open it in your preferred editor.

- Review Part I: Summary, ensuring the mission statement accurately reflects the organization's purpose and is succinct.

- In Line 5, input the number of employees and in Line 6, indicate the number of volunteers, verifying accuracy.

- Complete Lines 8 to 19 with financial summaries for the prior year and current year.

- In Part III: Program Service Accomplishments, provide a brief description of the mission in Line 1, ensuring it matches other documents.

- If applicable, describe significant program accomplishments, using additional space in Schedule O if needed.

- For Line 2, indicate any additions to programs or activities and confirm accuracy with reference to public charity guidelines.

- Check Part IV for any required schedules, particularly Line 2: Schedule B, making sure to provide necessary documentation.

- In Part V, confirm any nondeductible contributions in Line 6 and report quid pro quo contributions accurately.

- For Part VI, verify governance details such as the number of independent voting members and the existence of conflict of interest policies.

- In Part VII, include comprehensive information about officers, directors, and key employee compensation.

- Complete Parts VIII to X with revenue statements, expense distributions, and balance sheet information.

- Finally, review all completed components for accuracy, then save your changes, and prepare to download, print, or share the form.

Take the next steps and complete your Form 990 Public Relations Checklist online today.

Earning trust through financial transparency and accountability goes beyond what the law requires, but let's start there: nonprofits are required to disclose certain financial information to the public upon request, and board members must have access to financial information in order to fulfill their fiduciary duty to ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.