Loading

Get Notice Of Increase In 2008-09 Maximum Base Rent And Maximum Collectible Rent Computation (short

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice of Increase in 2008-09 Maximum Base Rent and Maximum Collectible Rent Computation (Short online)

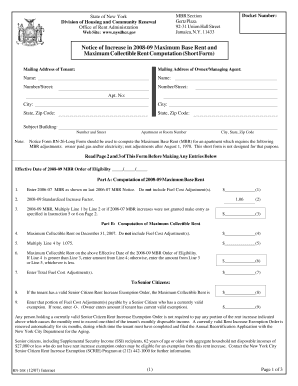

Filling out the Notice of Increase in 2008-09 Maximum Base Rent and Maximum Collectible Rent Computation (Short) is an important process for landlords and property managers. This guide will help you understand the form's components and provide step-by-step instructions on how to complete it correctly online.

Follow the steps to fill out your rent increase notice accurately.

- Click ‘Get Form’ button to access the form and open it in the editor for filling out.

- Enter the mailing address of the tenant clearly in the designated field. Make sure to include the name, number, street, apartment number, city, state, and zip code.

- Provide the mailing address of the owner or managing agent, following the same format as in step 2.

- Input the subject building's number and street, as well as the apartment or room number, city, state, and zip code under the appropriate sections.

- Read pages 2 and 3 of the form before entering any data, as they contain essential instructions.

- In Part A, begin computation of the 2008-09 Maximum Base Rent by entering the 2006-07 MBR as shown on the last notice, ensuring that fuel cost adjustments are excluded.

- Next, enter the 2008-09 standardized increase factor in line 2.

- Multiply the amount in line 1 by the increase factor from line 2 to obtain the 2008-09 MBR, and enter this result in line 3.

- In Part B, enter the maximum collectible rent on December 31, 2007, in line 4. Again, ensure to exclude any fuel cost adjustments.

- Multiply the amount from line 4 by 1.075 and enter this figure in line 5.

- For line 6, compare the amounts in line 4 and line 3; enter the greater amount from line 4, or the lesser amount from line 3 or line 5.

- Complete line 7 by entering the total fuel cost adjustments.

- If applicable, address the entries related to senior citizens in lines 8 and 9, providing valid amounts as necessary.

- Ensure to sign the affirmation section at the end of the form with the owner's, officer's, or agent's signature, along with the date.

- After completing all entries, you can save changes, download, print, or share the completed form online.

Start filling out your Notice of Increase online today to meet all necessary requirements.

Related links form

How to Negotiate a Rent Increase Ask for an explanation. If you are given a notice of a rent increase, ask the landlord for the reason behind it. ... Remain calm and polite. ... Remind them that you were a good tenant. ... Offer a compromise. ... Keep your options open if it doesn't work out initially.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.