Loading

Get Construction Summary Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Construction Summary Worksheet online

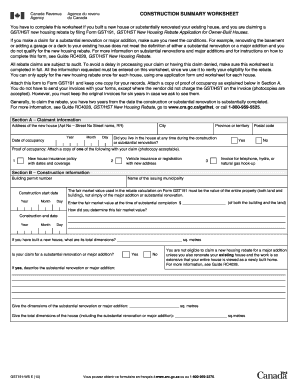

Completing the Construction Summary Worksheet is an essential step for anyone seeking a GST/HST new housing rebate. This guide provides clear, step-by-step instructions to help you successfully fill out this important form online.

Follow the steps to complete your Construction Summary Worksheet online.

- Click ‘Get Form’ button to access the Construction Summary Worksheet online and open it in the editor.

- Begin by entering your claimant information in Section A. Include the address of the new house, year, date of occupancy, city, province or territory, and postal code. Indicate whether you lived in the house during construction or substantial renovation.

- Attach proof of occupancy by including a photocopy of one of the acceptable documents such as a new house insurance policy or an invoice for utilities.

- Move to Section B and input the construction information. Record the building permit number, issuing municipality, construction start and end dates, fair market value, and dimensions of the new house or renovations.

- Specify whether your claim is for a substantial renovation or major addition, and describe the work done if applicable.

- Complete Section C by listing each vendor and corresponding invoices for the construction materials and services used. Include the vendor's name, Business Number, invoice date, number, amount, and specify if the invoice was for materials or labor.

- Ensure that you include all necessary totals from Pages 2 through 7 as per the guidelines laid out in the worksheet instructions.

- Once completed, review all entries for accuracy. You can then save your changes, download a copy, print the form, or share it as required.

Start completing your Construction Summary Worksheet online today to ensure your GST/HST new housing rebate process runs smoothly.

2023 GST on New Homes in BC Any property that is not brand new (has been lived in) and has been used for residential purposes in the past are exempt from GST. Essentially, the GST has already been paid for at the first point of purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.