Loading

Get 2013 Blank Organizer Forms - Schedule C Only

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Blank Organizer Forms - Schedule C Only online

This guide provides expert instructions for completing the 2013 Blank Organizer Forms - Schedule C Only online. Whether you are familiar with tax forms or new to this process, these step-by-step directions will support you in accurately filling out the necessary information.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the 2013 Blank Organizer Forms - Schedule C Only in your preferred editing software.

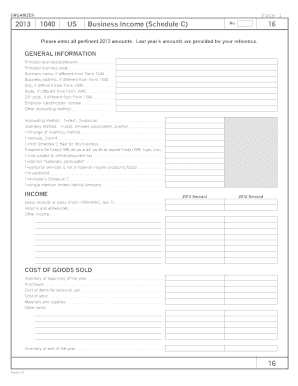

- Begin by entering your general information in the designated fields. This includes your principal business or profession, business code, name, and address, ensuring that your entries match those from your Form 1040 as needed.

- Proceed to the income section. Fill in the gross receipts or sales as indicated, and include any returns or allowances applicable to your business activities for 2013.

- Complete the cost of goods sold section. Enter your inventory amount at the beginning of the year, purchases, and costs related to goods sold. Be meticulous in detailing other costs associated with your business operation.

- Continue to the expenses section and list all relevant 2013 amounts. This includes categories such as accounting, advertising, legal, and any other expenses incurred in running your business.

- If applicable, fill out the asset disposition and acquisition lists for any business assets sold or purchased during 2013. Ensure all required information is complete to reflect changes accurately.

- Take note of the vehicle expenses section if you used a vehicle for business purposes. Record all pertinent information regarding vehicle use, including mileage and actual expenses incurred.

- Next, complete the business use of home section, indicating the area used for business and any related expenses as instructed.

- Finally, review all sections for accuracy before finalizing. Save your changes, then download your completed form ready for printing or sharing as needed.

Complete your documents online confidently and efficiently.

Accrue the warranty expense with a debit to the warranty expense account and a credit to the warranty liability account. As actual warranty claims are received, debit the warranty liability account and credit the inventory account for the cost of the replacement parts and products sent to customers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.