Loading

Get W-4 And I-9 Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

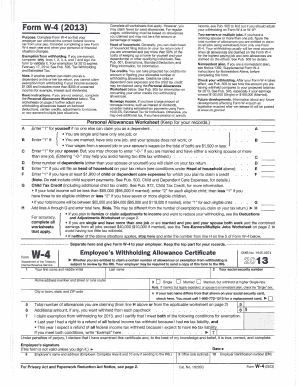

How to fill out the W-4 and I-9 forms online

Filling out the W-4 and I-9 forms online is essential for accurate tax withholding and verifying employment eligibility. This guide provides clear instructions to help users complete both forms with confidence.

Follow the steps to fill out the W-4 and I-9 forms effectively.

- Click ‘Get Form’ button to obtain the forms and open them for editing.

- For the W-4 form, begin with your personal information, including your name, address, and social security number. Ensure that your information matches official identification documents.

- Claim the appropriate number of allowances and exemptions by filling out the Personal Allowances Worksheet if required. This helps determine the right amount of federal income tax withholding.

- If needed, refer to additional worksheets for adjustments related to deductions or multiple jobs. This ensures more accurate withholding based on your financial situation.

- Once you have completed the W-4, ensure that all the information is accurate before submitting the form to your employer. Keep a copy for your records.

- For the I-9 form, input your personal information, including your last name, first name, and address, along with your date of birth and social security number.

- Select your citizenship or immigration status by checking the appropriate box on the form. Provide any required alien registration information if applicable.

- Sign the I-9 form to verify that all provided information is accurate and true to the best of your knowledge. Ensure to complete Section 1 no later than the first day of employment.

- After finishing both forms, save any changes made, and securely store your completed documents. You may also choose to download, print, or share them as needed.

Complete your W-4 and I-9 forms online today to ensure accurate tax withholding and verification of your employment eligibility.

Step 1: Have Your Employee Fill out Section 1 of the I-9 Form. ... Step 2: Have Your Employee Present Their Verification Documents. ... Step 3: Review Your Employee's Verification Documents. ... Step 4: Fill out Section 2 of the I-9 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.