Loading

Get Form 324 - Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 324 - Comptroller Of Maryland online

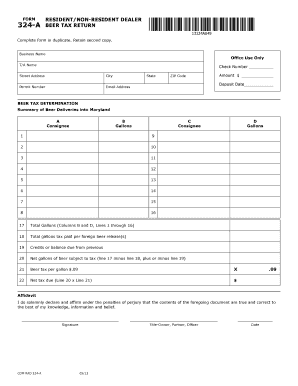

Filling out the FORM 324 - Comptroller Of Maryland, the beer tax return, is essential for reporting and submitting tax information related to beer deliveries. This guide provides detailed, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to complete your beer tax return effectively.

- Use the ‘Get Form’ button to access and open the form in your preferred online editing tool.

- Enter the business name in the designated field at the top of the form.

- Fill out the T/A name (trading as name) to clarify the business’s identity.

- Complete the check number field if submitting payment by check.

- Provide the street address, city, state, and ZIP code of the business location.

- Input the permit number assigned to the business.

- Enter the email address for correspondence regarding the tax return.

- Fill in the amount of tax due in the appropriate field.

- Provide the deposit date of the tax payment.

- For each consignee, list their names in the provided columns A and C.

- In columns B and D, input the number of gallons delivered to each consignee as detailed in your records.

- Calculate the total gallons delivered by summing the figures in columns B and D and enter this total in line 17.

- List the total gallons for which the tax has already been paid on line 18.

- Make any necessary adjustments to your tax return on line 19.

- Compute the net gallons subject to tax on line 20 by applying the appropriate calculations.

- Enter the Maryland beer tax rate ($0.09) on line 21.

- Multiply the amount from line 20 by the tax rate on line 21, entering the result on line 22.

- Affirm the accuracy of the form by having it signed by an authorized individual: owner, partner, or officer of the corporation, filling in their title and the date.

- After finalizing the form, save your changes, and prepare to submit it by downloading or printing the document as needed.

Complete your FORM 324 online now to ensure timely filing and compliance.

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.