Loading

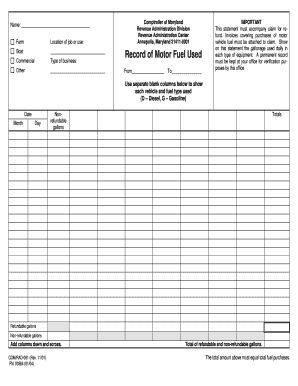

Get Record Of Motor Fuel Used - Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Record Of Motor Fuel Used - Comptroller Of Maryland online

This guide provides clear, step-by-step instructions on how to complete the Record Of Motor Fuel Used form from the Comptroller of Maryland. It aims to assist users in accurately documenting their motor fuel usage for claims of refund.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the name of the entity or individual submitting the claim. This section is crucial for identification purposes.

- Indicate the location of the job or the specific use of the motor fuel. This may include details that specify the site where the fuel was used, such as 'boat operation' or 'commercial vehicle use.'

- Specify the type of business involved by selecting from the provided options (for example, indicate if it is commercial or another type of business).

- Enter the date range for the fuel usage by filling out the 'From' and 'To' fields. This range defines the period for which the records are being submitted.

- Complete the table by listing the date, month, and day for every usage entry and fill in the gallons used for each type of equipment on a daily basis.

- Separate the gallonage into refundable and non-refundable categories as necessary. Ensure that totals are calculated accurately down and across.

- Add together the total refundable and non-refundable gallons and ensure that this total equals the total amount of fuel purchased. This step is essential for verification.

- Ensure all invoices covering purchases of motor vehicle fuel are attached to the claim, as this is a requirement for processing by the Comptroller’s office.

- Once all sections are completed and double-checked for accuracy, you can save your changes, download, print, or share the completed document as required.

Complete your documents online today for a smooth filing experience.

Gas tax and price in select U.S. states 2022 California has the highest tax rate on gasoline in the United States. As of March 2022, the gas tax in California amounted to 68 U.S. cents per gallon, compared with a total gas price of 5.79 U.S. dollars per gallon.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.