Loading

Get Form 507

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 507 online

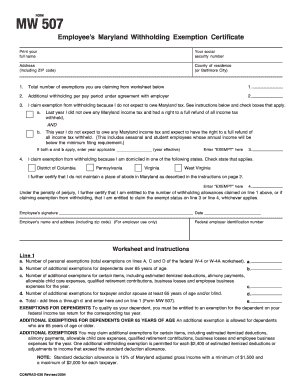

The Form 507 is the Employee’s Maryland Withholding Exemption Certificate, which enables employees to claim exemptions from Maryland income tax withholding. Filling out this form accurately is essential to ensure the correct amount of taxes are withheld from your paychecks.

Follow the steps to complete the Form 507 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Print your full name in the designated field at the beginning of the form.

- Enter your social security number in the appropriate section.

- Provide your address, including ZIP code, in the specified space.

- Indicate your county of residence or Baltimore City in the designated area.

- In the first section, specify the total number of exemptions you are claiming by referencing the worksheet.

- If applicable, enter any additional withholding per pay period that you have agreed upon with your employer.

- If you believe you are exempt from withholding, check the relevant boxes and provide the year you are referring to.

- Complete the certification lines for residing in exempt states if you are domiciled outside of Maryland.

- At the bottom of the form, sign and provide the date.

- Include your employer's name and address in the designated area for employer use.

- Review all the information for accuracy, then proceed to save changes, download, print, or share the completed form as needed.

Take action today by completing your Form 507 online to ensure proper tax withholding.

Claiming 1 on Your Taxes Claiming 1 reduces the amount of taxes that are withheld, which means you will get more money each paycheck instead of waiting until your tax refund. You could also still get a small refund while having a larger paycheck if you claim 1. It just depends on your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.