Loading

Get Multiple Rental Property Worksheet Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Multiple Rental Property Worksheet Fillable Form online

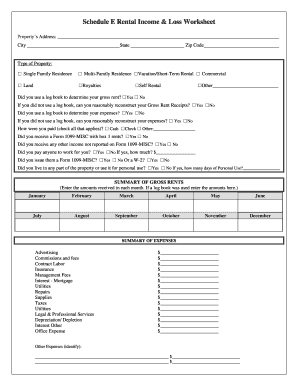

Filling out the Multiple Rental Property Worksheet Fillable Form online can simplify your tax preparation process. This guide will walk you through each section of the form, ensuring you understand how to accurately complete it for your rental property income and expenses.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the worksheet and open it in your preferred editor.

- Begin by entering the property’s address, including the city, state, and zip code in the designated fields.

- Select the type of property from the options provided, including categories such as single family residence, multi-family residence, vacation/short-term rental, and more.

- Indicate whether you used a log book to determine your gross rent and expenses by checking the appropriate boxes. If you did not use a log book, you can respond to whether you can reasonably reconstruct these amounts.

- Detail your payment methods by checking all applicable options such as cash or check, and indicate if you received a Form 1099-MISC for rental income.

- Specify if you received any other income not reported on Form 1099-MISC.

- If you paid anyone for work related to the property, indicate

- Fill in the summary of gross rents received for each month of the year. If applicable, enter amounts based on your logbook.

- Complete the summary of expenses, listing amounts for each category including advertising, management fees, utilities, and more.

- Add any additional expenses that apply, ensuring you identify and label other expenses clearly.

- If claiming vehicle expenses, complete the vehicle section with details such as usage, cost, and the method for determining vehicle expenses.

- Sign the statement acknowledging that you have the necessary receipts and records to support your deductions. Print your name, social security number or ITIN, and include your signature and date.

- Lastly, save your changes and consider downloading, printing, or sharing the completed form as necessary.

Start filling out your Multiple Rental Property Worksheet Fillable Form online today to ensure a smooth tax preparation process.

Individual companies with multiple properties Create a Company. Set up a Chart of Accounts. List the rental property as a Fixed Asset on the Chart of Accounts. Add business bank, savings, credit card, and mortgage accounts. Configure the property as a Class. Create the tenant as a Customer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.