Loading

Get It-40rnr - Icpr: State Forms Online Catalog - In.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IT-40RNR - ICPR: State Forms Online Catalog - IN.gov online

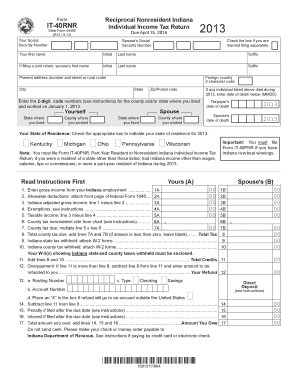

Filling out the IT-40RNR form is an essential step for individuals who have income from Indiana but are not residents of the state. This guide provides clear, step-by-step instructions for completing the online form, ensuring a smooth filing process.

Follow the steps to accurately complete the IT-40RNR form.

- Press the ‘Get Form’ button to access the IT-40RNR form, which will open in the editor for you to fill out.

- Begin by entering your Social Security number in the designated field. If you are married filing separately, ensure to check the appropriate box for this status.

- Fill in your name in the fields provided — first name, middle initial, last name, and any suffix as applicable.

- Complete your present address with the street number, city, state, and zip/postal code. If you reside in a foreign country, include its 2-character code.

- Enter the codes for the county and state where you lived and worked on January 1, 2013. Ensure correctness by referring to the instruction chart.

- If applicable, indicate any individuals listed who passed away during 2013 by entering their date of death.

- Select your state of residence from the options provided and check the corresponding box.

- Calculate and fill in your income details. Input your gross income from Indiana employment, allowable deductions, and calculate your Indiana adjusted gross income by subtracting deductions from your income.

- Determine any applicable exemptions and fill in your taxable income. Follow the form's instructions to ensure accuracy.

- Review the county tax information section, enter the nonresident rates from the provided chart, and compute the total tax due.

- If applicable, enter any Indiana state and county tax withheld figures from your W-2 forms. Remember to attach W-2s to verify these amounts.

- Complete the direct deposit section if you wish to receive your refund via direct deposit, including your bank account details.

- After filling out all necessary fields, review your form to ensure completeness and accuracy before proceeding to save your changes, download, print, or share the completed form.

Start filling out your IT-40RNR form online today to ensure timely and accurate submission.

Always force a page break before a paragraph Select the paragraph that you want to follow the page break. On the Home tab in Word, or on the FORMAT TEXT tab in an Outlook email, select the Paragraph Dialog Box launcher . Select the Line and Page Breaks tab. Under Pagination, select Page break before. Select OK.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.