Loading

Get Quick Reference - Resolve Errors - Virginia Department Of Taxation - Tax Virginia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Quick Reference - Resolve Errors - Virginia Department Of Taxation - Tax Virginia online

Navigating tax forms can be challenging, especially when it comes to resolving errors in your submission. This guide provides comprehensive, step-by-step instructions on how to fill out the Quick Reference - Resolve Errors document from the Virginia Department Of Taxation, ensuring you can successfully address any issues that may arise.

Follow the steps to effectively resolve errors in your tax submissions.

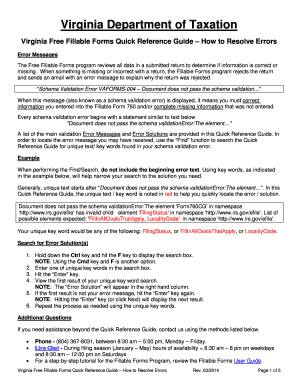

- Press the ‘Get Form’ button to access the Quick Reference document and open it for review.

- Identify any error messages received. Start by locating the error message within the form and understanding its implications.

- Use the 'Find' function in the Quick Reference Guide to search for unique keywords from your error message. Hold down the Ctrl key and hit the F key, or alternatively, use the Cmd key and F.

- Enter one of the unique keywords from the error message into the search box, then press the 'Enter' key to navigate to the error solution.

- Review the solutions provided alongside the error. They will be aligned in the right-hand column for easy reference.

- If the first result does not address your error, continue pressing 'Enter' or click 'Next' to cycle through additional results.

- Once you've found the appropriate solution, follow the detailed instructions provided to rectify the error in your online submission.

- After making the necessary corrections, you can save changes, download, print, or share the form as needed.

Start resolving your tax document errors online today for a smoother filing experience.

Why was your refund reduced or withheld (offset)? If you owe money to certain government agencies and institutions, we are authorized to withhold or reduce (offset) your Virginia tax refund to satisfy the debt, in ance with the Virginia Debt Collection Act (Va. Code § 2.2-4800 et seq.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.