Loading

Get Certificate Of Self Employment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of Self Employment online

Filling out the Certificate Of Self Employment online can be a straightforward process when guided properly. This document is essential for self-employed individuals to confirm their income for various purposes, including financial assessments.

Follow the steps to complete the Certificate Of Self Employment online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

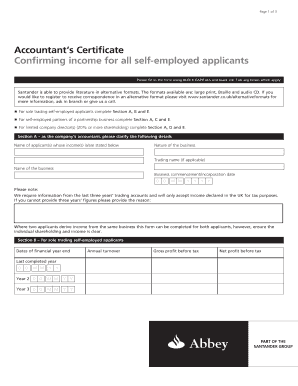

- In Section A, provide your name and other identifying details, including the nature of your business and the trading name, if applicable. Also, include the business commencement date in the format DD/MM/YYYY.

- For sole traders, complete Section B by entering the dates for the financial year-end and relevant income details such as annual turnover, gross profit, and net profit before tax for the last three completed years.

- If you are a self-employed partner, fill out Section C with the percentage of your shareholding and the same financial year-end details as in Section B, ensuring to allocate shares and income appropriately.

- For limited company directors with 20% or more shareholding, proceed to Section D. Record the number of shares held, company registration number, and the same financial year-end details as above, including your salary and dividends.

- In Section E, make any necessary comments or notes regarding the accounts and provide a professional opinion on the net profit before tax attributed to the applicants.

- Ensure to include the accountant’s name, qualifications, firm details, and signature. Only pages 1 and 2 need to be sent as part of the submission.

- Once you have filled out all sections accurately, save your changes, and utilize the options to download, print, or share the completed form as needed.

Complete your Certificate Of Self Employment online today to confirm your income efficiently.

If you or your partner are employed, you could include: bank statements showing you or your partner's income. 6 months of payslips. a letter from an employer, dated and on headed paper.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.