Loading

Get Compare Form 8938 And Fbar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Compare Form 8938 And FBAR online

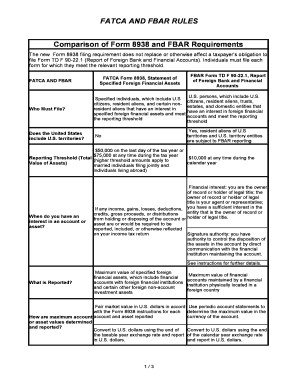

Filling out tax forms can be daunting, but understanding the differences and requirements for Form 8938 and FBAR can simplify the process. This guide will provide you with step-by-step instructions to effectively complete these forms online.

Follow the steps to complete your forms accurately.

- Click ‘Get Form’ button to obtain the form and open it in your editor of choice.

- Begin by identifying if you meet the filing requirements for Form 8938 or FBAR. Ensure you understand your status as a specified individual for Form 8938 or as a U.S. person for FBAR.

- Determine the reporting threshold applicable to you. For Form 8938, the threshold includes $50,000 on the last day of the tax year or $75,000 at any time during the year. For FBAR, any amounts over $10,000 at any time during the calendar year must be reported.

- Provide information about your interest in foreign financial assets. Clearly indicate whether you have a financial interest or signature authority over the assets listed.

- Report the maximum value of your specified foreign financial assets on Form 8938. Ensure you convert your asset values to U.S. dollars using the appropriate exchange rate.

- For FBAR, report the maximum value of your foreign financial accounts as per the previous account statements, again converting to U.S. dollars as needed.

- Review the reporting requirements for the types of assets you hold and ensure you are compliant with the necessary disclosures.

- Once all sections are complete, review your forms for accuracy and completeness.

- Save your changes, and decide whether to download, print, or share your completed forms as needed.

Start completing your documents online today to ensure compliance with tax requirements.

FBAR, is that the Form 8938 is only filed when a person meets the threshold for filing AND has to file a tax return. So, if a person does not have to file a tax return (because for example, they are below the threshold) than the 8938 is not required in the current year either.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.