Loading

Get Completed Sample 8283 Form - With This Ring - Withthisring

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Completed Sample 8283 Form - With This Ring - Withthisring online

This guide provides clear and supportive instructions for filling out the Completed Sample 8283 Form - With This Ring - Withthisring online. Whether you are a seasoned user or new to tax forms, this comprehensive walkthrough will assist you in successfully completing the form.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

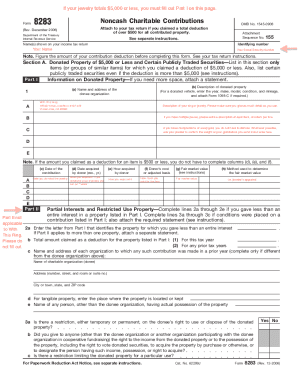

- Enter your identifying information. This includes your name and Social Security Number. Make sure this information matches that on your income tax return.

- Start Part I by detailing the donated property information if it totals $5,000 or less. Provide a complete description of the donated jewelry, including the year, make, model, and condition if applicable.

- List multiple donated items, one per line, if applicable. If you have multiple pieces of scrap gold, you only need to provide total weight as confirmed by your jeweler.

- Include the date you donated the jewelry in the designated field.

- Complete additional information fields if your total deduction exceeds $5,000. If appraisals are required, be sure to attach the necessary documentation.

- If applicable, fill out Part II by declaring any restrictions on the donated property or if you gave less than an entire interest.

- Once all information is entered, review for accuracy, and make any necessary edits.

- Save changes to the form, then download, print, or share the completed document as needed.

Complete your documents online today for a smooth filing experience!

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.