Loading

Get Irs Form 2678

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 2678 online

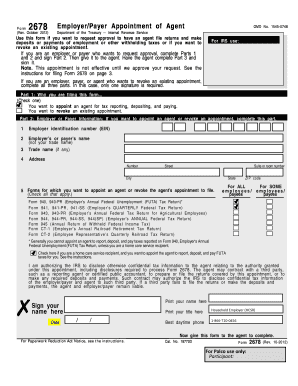

Filling out IRS Form 2678 is essential for employers or payers looking to appoint an agent for tax-related tasks. This comprehensive guide will provide you with clear, step-by-step instructions to help you navigate the process of completing this form online.

Follow the steps to fill out the IRS Form 2678 conveniently online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In Part 1, indicate why you are filing the form by checking the appropriate box. You can choose to either appoint an agent for tax reporting or revoke an existing appointment.

- Proceed to Part 2, where you will need to provide your employer identification number (EIN) along with your name, trade name, and complete address, including the city, state, and ZIP code.

- In this section, check the boxes for all applicable forms for which you are appointing an agent or revoking their appointment. Ensure to include specific forms such as 940, 941, 943, 944, 945, CT-1, and CT-2 as necessary.

- If you are a home care service recipient, ensure to check the corresponding box to authorize the appointment of an agent to handle FUTA taxes.

- Authorize the IRS to disclose tax information to the agent by signing and dating the form. Additionally, print your name and title to confirm your role.

- Once all sections are completed, review the form for accuracy. You can now save changes, download, print, or share the form as needed.

Start filling out your IRS Form 2678 online today for a smooth tax appointment process!

Use Form 2678 if you want to: Request approval to have an agent file returns and make. deposits or payments of Federal Insurance Contributions Act. (FICA) taxes, Railroad Retirement Tax Act (RRTA) taxes, income. tax withholding (ITW), or backup withholding; or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.