Loading

Get Win/loss W2g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Win/Loss W2G online

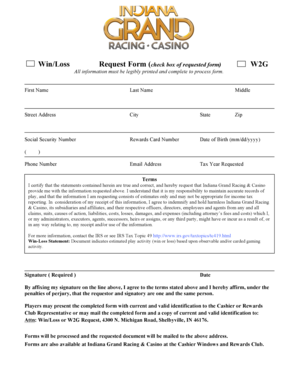

Navigating the Win/Loss W2G form is essential for individuals seeking to document their gaming activities. This guide provides you with step-by-step instructions on how to accurately complete the form online, ensuring all needed details are properly submitted.

Follow the steps to successfully fill out the Win/Loss W2G form online.

- Press the ‘Get Form’ button to access the Win/Loss W2G form and open it in your editor.

- Begin filling out the form by entering your first name in the designated field.

- Next, input your last name in the appropriate section.

- Provide your street address, ensuring it is complete for accurate processing.

- Enter your city of residence in the specified area.

- Fill in your state, using the appropriate abbreviation.

- Add your complete zip code in the respective field.

- Input your Social Security Number securely in the designated space.

- Enter your Rewards Card Number if applicable.

- Provide your date of birth in the format mm/dd/yyyy.

- Fill in your email address for correspondence.

- Indicate the tax year requested by selecting from the available options.

- Add your phone number where you can be reached for any clarifications.

- Read the terms carefully. Confirm your agreement by affixing your signature in the required section.

- Date your signature to affirm the form's accuracy.

- Once completed, you can save your changes, download the form, print a copy, or share it as needed.

Complete your Win/Loss W2G form online today to ensure you have the necessary documentation for your gaming activities.

Consequences of Not Claiming Casino Winnings on Your Taxes For the most part, you will have to take into consideration the amount you have failed to report, your overall earnings, as well as your overall tax history. Put another way, there is no legal outcome if you fail to report your gambling winnings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.