Loading

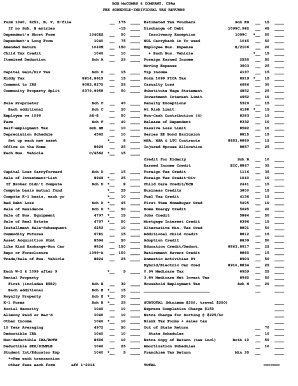

Get Fee Schedule-individual Tax Returns Form 1040, 6251, B ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FEE SCHEDULE-INDIVIDUAL TAX RETURNS Form 1040, 6251, B ... online

Completing the FEE SCHEDULE-INDIVIDUAL TAX RETURNS Form 1040, 6251, B ... can seem daunting, but with clear guidance, you can navigate the process smoothly. This guide provides step-by-step instructions to help you fill out the form online effectively.

Follow the steps to complete your form online.

- Press the ‘Get Form’ button to access the FEE SCHEDULE-INDIVIDUAL TAX RETURNS Form 1040, 6251, B ... and open it for editing.

- Review the first section that typically includes your identifying information. Ensure your name, address, and taxpayer identification number are accurately filled in.

- Locate the fee schedule, which outlines the costs associated with different services. Ensure that you understand each fee listed next to the specific forms, including any applicable discounts or additional charges.

- Fill in any required fields under each section based on your specific tax situation. For example, if you have dependents or specific deductions, complete those fields accordingly.

- Double-check each entry for accuracy, ensuring that totals are calculated correctly, especially in sections with multiple fees or charges.

- Once you have completed filling out the form, you can save your changes. You may also download a copy, print it for your records, or share it electronically as needed.

Begin completing your FEE SCHEDULE-INDIVIDUAL TAX RETURNS Form online today for a seamless experience.

If your income is over the stated level, you're taxed at a rate of 28 percent on the excess income. This means that for a single person who earned more than $75,900 in 2022, but less than $206,100, the AMT rate is 26 percent. If that person earned more than $206,100, the AMT tax rate goes up to 28 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.