Loading

Get Il 941

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL-941 online

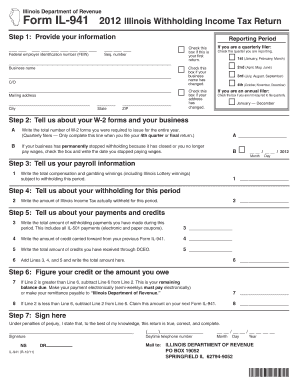

This guide provides comprehensive and supportive instructions on how to complete the IL-941 online. The IL-941 is an important document for reporting Illinois withholding income tax, and our expert analysis will help you navigate each section with confidence.

Follow the steps to fill out the IL-941 accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your information: Indicate the reporting period by checking the appropriate box for quarterly or annual filers. Enter your federal employer identification number (FEIN) and business name, and specify your mailing address. If your business name or address has changed, remember to check the respective boxes.

- If you are an annual filer, indicate that you do not need to file quarterly. For quarterly filers, select the corresponding quarter you are reporting on.

- In this section, report the total number of W-2 forms issued for the year if you are filing your final return or fourth quarter. Also, indicate if your business has permanently ceased withholding by checking the box and providing the cessation date.

- Next, provide your payroll information. Enter the total compensation and gambling winnings subject to withholding for the reporting period.

- Report the amount of Illinois income tax actually withheld during this period.

- Detail your payments and credits during the period: Include the total withholding payments made, any credit carried forward from a previous form, and credits received through DCEO. Add these amounts to present your total.

- Calculate your credit or the amount owed: If your withholding amount is greater than your total payments and credits, note the remaining balance due. For excess credits, indicate the amount to claim on your next form.

- Finally, ensure to sign and date your return. Failure to sign may result in penalties. Once completed, save changes and consider downloading, printing, or sharing the form as needed.

Complete your IL-941 form online today to ensure you're meeting your withholding tax responsibilities.

Note: Form IL-941 is the only form used to report Illinois income tax withholding with the exception of household employee withholding, which can be reported on Form IL-1040, Individual Income Tax return. If you have household employees, see Publication 121, Illinois Income Tax Withholding for Household Employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.