Loading

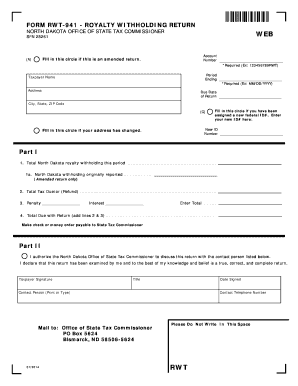

Get Form Rwt-941 - Royalty Withholding Return - State Of North Dakota - Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RWT-941 - Royalty Withholding Return - State Of North Dakota - Nd online

Filling out the Form RWT-941, the Royalty Withholding Return for North Dakota, is an essential task for individuals and businesses required to withhold state income tax on oil or gas royalty payments. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the Form RWT-941 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred browser.

- Enter your account number, ensuring it matches the format required (e.g., 123456789RWT).

- Indicate if this is an amended return by filling in the appropriate circle.

- Provide the period ending date in the specified format (MM/DD/YYYY) and the taxpayer name.

- Fill out your address, including the city, state, and ZIP code.

- Specify the due date of the return according to the quarter being reported.

- If applicable, fill in the circle indicating if you have a new federal ID number and enter the new ID number.

- If there has been a change to your address, fill in the corresponding circle.

- In Part I, enter the total North Dakota royalty withholding for the period on line 1. If this is an amended return, also enter the amount originally reported on line 1a.

- Calculate the total tax due or refund, and if there are penalties or interest, calculate those amounts and add them to determine the total due with the return on line 4.

- In Part II, authorize the North Dakota Office of State Tax Commissioner to discuss this return with your designated contact person.

- Sign the form as the taxpayer, include your title, the date signed, and the contact person's information.

- Finally, review all information for accuracy, save your changes, and print or download the completed form as needed before mailing it.

Complete and submit your Form RWT-941 online today to ensure compliance with North Dakota tax regulations.

The withholding amount is determined by multiplying the gross amount of the North Dakota oil or gas royalty by the highest marginal individual income tax rate reduced by 0.75%. The highest individual income tax rate is 2.90%, resulting in a withholding tax rate of 2.15% (2.90% - 0.75%).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.