Loading

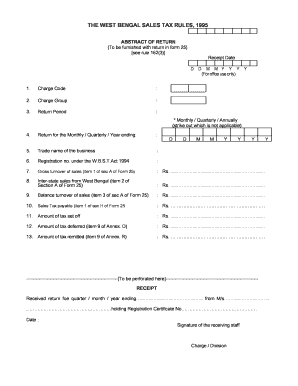

Get The West Bengal Sales Tax Rules, 1995 Abstract Of Return (to Be Furnished With Return In Form 25)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the THE WEST BENGAL SALES TAX RULES, 1995 ABSTRACT OF RETURN online

This guide provides a detailed walkthrough on how to complete the THE WEST BENGAL SALES TAX RULES, 1995 ABSTRACT OF RETURN online. By following the steps outlined below, users will be able to accurately and efficiently fill out the necessary information required for the return in Form 25.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the 'Receipt Date' using the format DD/MM/YYYY. This date is primarily for office use.

- Fill in the 'Charge Code' by referring to the two letters from your Registration Certificate number. For example, if your number is CR/1205, your Charge Code is CR.

- Indicate the 'Charge Group', which corresponds to your assessment group.

- Select the 'Return Period' — Monthly, Quarterly, or Annually — and strike out the options that do not apply.

- Complete the section for the 'Return for the Monthly / Quarterly / Year ending', providing the month and year accurately.

- Provide the 'Trade name of the business', ensuring it matches the details on your registration.

- Enter the 'Registration number under the W.B.S.T. Act 1994', as shown on your certificate.

- Report the 'Gross turnover of sales' as per item 1 of Section A of Form 25, stating the amount in Indian Rupees.

- Next, enter details on 'Inter-state sales from West Bengal' as mentioned in item 2 of Section A.

- Fill in the balance turnover of sales found in item 3 of Section A.

- Calculate the 'Sales Tax payable' based on item 1 of Section H of Form 25, and state that amount.

- Document the 'Amount of tax set off' and 'Amount of tax deferred', as applicable.

- Finally, provide the 'Amount of tax remitted' as recorded in Annexure R.

- After completing all sections, ensure to review your entries for accuracy, then save your changes, and proceed to download, print, or share the completed form.

Complete your documents online today to ensure compliance with The West Bengal Sales Tax Rules.

Published by : Shri PARTHA PRATIM BARMAN, DCIT, Hqrs., (Co-ordination), Kolkata.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.