Loading

Get Form Cpf Se 8 Declaration Of Non Self-employed Status - Cpf Board - Mycpf Cpf Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Cpf Se 8 Declaration Of Non Self-employed Status - CPF Board - Mycpf Cpf Gov online

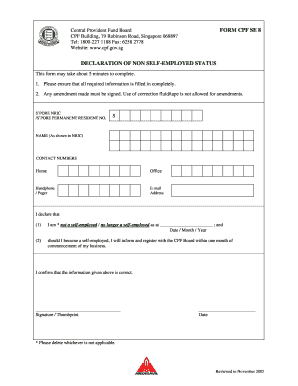

The Form Cpf Se 8 is essential for declaring your non self-employed status to the CPF Board. This guide will provide you with clear, step-by-step instructions to complete the form online accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form; this will open the document in your selected editor for completion.

- Enter your Singapore NRIC or Singapore Permanent Resident number in the designated field. Ensure this is accurate as it identifies your record.

- Fill in your name exactly as it appears on your NRIC. This step is crucial for correctly associating your declaration with your official identification.

- Provide your contact numbers. Include your home, office, and mobile or pager numbers to ensure that you can be contacted if necessary.

- Input your email address in the given field, as this may be used for future communication regarding your declaration.

- In the declaration section, specify the date on which you are stating you are not self-employed. Ensure the date is filled in the format of day/month/year.

- Acknowledge that, if you do become self-employed in the future, you will inform and register with the CPF Board within one month of starting your business.

- Sign or provide your thumbprint next to the signature field to confirm your declaration. Ensure this is done in accordance with the guidelines provided.

- Finally, date your signature to complete the form. After checking for accuracy, you have options to save changes, download, print, or share the completed form.

Start completing your declaration online now to ensure it is processed promptly.

The 2 CPF contribution schemes specific to the self-employed The Government mandates that all self-employed personnel have to contribute to their MediSave Account as long as they earn more than $6,000 in Net Trade Income (NTI) for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.