Loading

Get 740 Np R 2015 Online Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 740 Np R 2015 Online Form online

Filling out the 740 Np R 2015 Online Form can be a straightforward process if you follow the right steps. This guide provides a comprehensive overview of how to complete the form efficiently and effectively, ensuring you do not miss any crucial details.

Follow the steps to complete the 740 Np R 2015 Online Form

- Press the ‘Get Form’ button to access the form and open it in your preferred online platform.

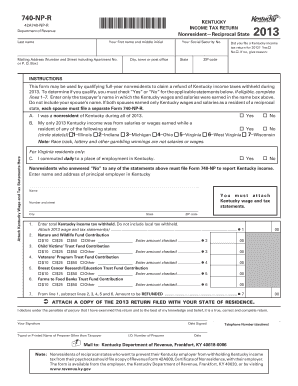

- In the first section, fill in your last name, first name, and middle initial.

- Enter your mailing address, including the street number and apartment number if applicable, along with your city, state (Kentucky), and ZIP code.

- Provide your Social Security number in the designated field.

- Indicate the tax year, which in this case is 2013.

- Indicate whether you filed a Kentucky income tax return for 2012 by checking 'Yes' or 'No.' If you select 'No,' briefly explain the reason in the provided space.

- Review the eligibility statements; check 'Yes' or 'No' to statement A, B, and, if applicable, C. Ensure to circle any states relevant to your situation.

- List your principal employer's name and address in Kentucky.

- Attach the required Kentucky wage and tax statements in the designated area.

- Fill in the total amount of Kentucky income tax withheld from your wages, ensuring to exclude any local taxes.

- Complete the sections for contributions to various trust funds by checking the amounts you wish to contribute.

- Calculate the amount to be refunded by subtracting the contributions from the total tax withheld.

- Sign and date the form, including the printed name of any preparer other than yourself, if applicable.

- Ensure to attach a copy of your 2013 state return before submitting.

- After completing all steps, review the form for accuracy, then save your changes, and download or print the form as needed.

Complete your 740 Np R 2015 Online Form online today for a hassle-free tax refund process!

Exemption From Withholding If an employee qualifies, he or she can also use Form W-4 to tell you not to deduct any federal income tax from his or her wages. To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.