Loading

Get Guarantor Form For Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guarantor Form For Loan online

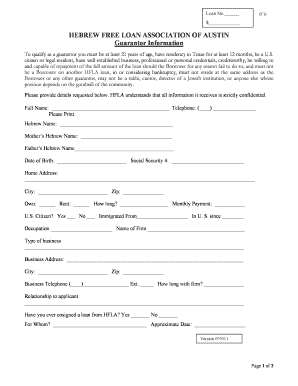

Completing the Guarantor Form for a loan can seem daunting, but this guide will simplify the process. By following these step-by-step instructions, you will ensure that all necessary information is accurately provided, making the application process smoother.

Follow the steps to fill out the Guarantor Form effectively.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Provide your full name in the designated field, ensuring it is printed clearly.

- Enter your telephone number, including the area code, in the appropriate box.

- Fill in your Hebrew name and your mother’s and father’s Hebrew names as requested.

- Indicate your date of birth and Social Security number in the specified fields.

- Complete your home address, including the city and zip code, and specify whether you own or rent your residence. Include how long you have lived there and your monthly payment.

- Answer whether you are a U.S. citizen or provide information about your immigration status, if applicable.

- State your occupation and the name of your firm. Additionally, describe the type of business.

- Fill in your business address, city, and zip code, and provide your business telephone number and extension.

- Mention how long you have been with the firm and your relationship to the loan applicant.

- Indicate if you have ever co-signed a loan from the Hebrew Free Loan Association (HFLA) and provide details if applicable.

- Provide your synagogue affiliation and rabbinic reference if you have one.

- List your annual income from all sources in the designated section.

- In the bank information section, list the name and branch of your bank along with the balances of your checking, savings, money market, and any other accounts.

- Detail any other assets in your name, including their amounts.

- Complete the liabilities section by listing outstanding loan balances, credit card balances, and obligations along with their amounts and monthly payments.

- Confirm if you have adequate liquid, unencumbered assets to pay off the loan if required.

- Sign and date the form, confirming that the information provided is truthful and accurate.

- Once you complete all sections, save your changes, and choose to download, print, or share the form as needed.

Take the first step toward completing your documents online today.

List of Documents Required for Loan Guarantor Liabilities Statement and Personal Assets. 2 photographs passport sized. Identify proof. Residence proof. Proof of business address. Signature identification from present bankers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.