Loading

Get Mileage Claim

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mileage Claim online

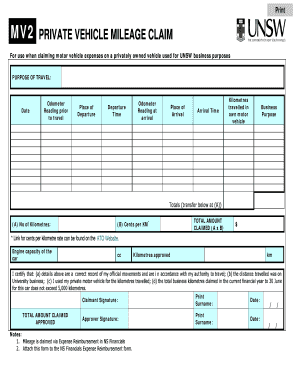

Filing a Mileage Claim online is essential for accurately reimbursing motor vehicle expenses incurred during business travel. This guide will walk you through each component of the form, ensuring a smooth and efficient completion process.

Follow the steps to effectively complete your Mileage Claim

- Click ‘Get Form’ button to obtain the Mileage Claim form and open it in your preferred editor.

- Fill in the 'Purpose of Travel' section. Specify the business reason for your travel to help substantiate the claim.

- Enter the date of travel accurately for record-keeping purposes.

- Input your odometer reading prior to starting your journey in the designated field.

- Provide the place of departure to indicate where your journey began.

- Document the departure time, ensuring this reflects the actual time you commenced the trip.

- Record the odometer reading upon arrival at your destination.

- Fill in the place of arrival to clarify where your travel ended.

- Note the arrival time to complete the travel record.

- Calculate the total kilometers traveled in your private vehicle and input this value in the corresponding field.

- Specify the business purpose for the travel, providing context for your trip.

- Transfer the total kilometers traveled to the section marked (A), and identify the applicable cents per kilometer rate (B) from the ATO website.

- Compute the total amount claimed by multiplying (A) by (B), and enter this value in the 'Total Amount Claimed' field.

- Record the engine capacity of your vehicle in cc to offer additional vehicle details.

- Complete the section on kilometers approved, ensuring the numbers align with your records.

- Confirm your details by signing in the 'Claimant Signature' field and date your entry.

- Ensure the form is reviewed and approved by obtaining the required approver signature.

- To finalize, save your changes, download the completed form, print, or share it as necessary.

Complete your Mileage Claim online today to ensure timely reimbursement for your business travel expenses.

The Internal Revenue Service is giving some taxpayers who use their cars for business a much-appreciated bonus: a boost of three-and-a-half cents per mile, bringing the mileage deduction to 58 cents per mile in 2019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.