Loading

Get Tennessee Department Of Revenue Short Form Inheritance ... - Tn.gov - Tn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tennessee Department of Revenue Short Form Inheritance Tax Return online

Filling out the Tennessee Department of Revenue Short Form Inheritance Tax Return is an essential step for personal representatives handling an estate. This guide provides clear instructions to ensure the process is straightforward and manageable for everyone, including those with little legal experience.

Follow the steps to successfully complete your form.

- Click the ‘Get Form’ button to access the form and open it for editing.

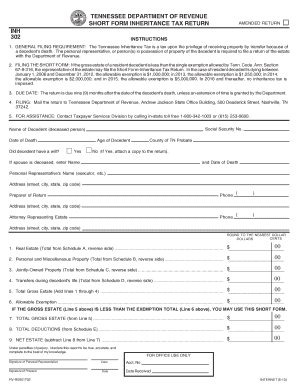

- Begin by filling out the personal information section, including the deceased person's Social Security number, name, and date of death. Indicate whether the decedent had a will by checking 'Yes' or 'No'.

- If the decedent's spouse is deceased, enter their name and date of death.

- Complete the personal representative's details, including their name, address, and phone number.

- If applicable, provide the details for the preparer of the return and the attorney representing the estate.

- Proceed to list the value of the estate's assets in corresponding sections. Include totals from Schedule A (real estate), Schedule B (personal and miscellaneous property), Schedule C (jointly-owned property), and Schedule D (transfers during the decedent's life).

- Calculate the total gross estate by adding the values listed in lines 1 through 4, and enter this amount on line 5.

- Deduct the allowable exemption amount from the total gross estate. If the gross estate (line 5) is less than the exemption (line 6), you are eligible to use this short form.

- Calculate the net estate by subtracting total deductions from the total gross estate and enter the result on line 9.

- Finally, sign and date the form as the personal representative. If applicable, include the signature of the preparer.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your form online today to ensure your filing is accurate and timely.

Related links form

Other relatives are exempt up to $15,000 ($40,000 in 2023) and unrelated heirs up to $10,000 ($25,000 in 2023). Prior to 2023, the tax rates above those exemptions are 1%, 13%, and 18%, respectively. Starting in 2023, those rates rise to 1%, 11%, and 15%, respectively.131415.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.