Loading

Get Scioto Downs Win Loss Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scioto Downs Win Loss Statement online

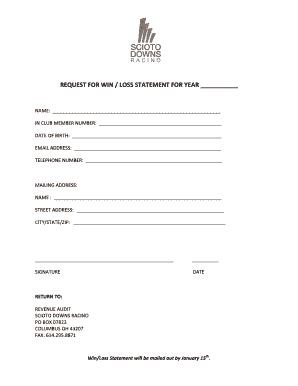

The Scioto Downs Win Loss Statement is a crucial document for individuals seeking to track their gaming activities for the year. This guide provides step-by-step instructions to help you navigate the online process of filling out this statement accurately and efficiently.

Follow the steps to complete the Win Loss Statement online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your full name in the 'NAME' field. Ensure that all information is accurate and matches the identification documents you may need to provide.

- Next, input your club member number in the designated field. This number is essential for identifying your records within the system.

- Enter your date of birth in the format requested, ensuring compliance with any age verification requirements that may apply.

- Provide your email address in the 'EMAIL ADDRESS' field. Double-check for accuracy to ensure you receive your statements without issues.

- Fill in your telephone number. This is vital for any follow-up communications related to your Win Loss Statement.

- In the mailing address section, detail your name again if required, followed by your street address, city, state, and ZIP code. This will be the address used for sending your Win Loss Statement.

- Sign the form in the 'SIGNATURE' field, indicating your consent for the information provided. This step is crucial for the validation of your request.

- Enter the date on which you are signing the form. Accurate dating is essential for processing your request.

- Once you have completed all fields, review your information for accuracy. After verifying the details, save any changes made, then proceed to download, print, or share the form as needed.

Complete your Scioto Downs Win Loss Statement online today to ensure your records are accurately documented.

A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.