Loading

Get Your Own Credit Repair Business Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Your Own Credit Repair Business Form online

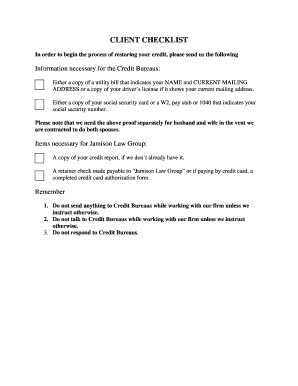

This guide provides clear instructions for users on how to effectively complete the Your Own Credit Repair Business Form online. By following these steps, you can ensure that your information is accurately submitted to start the credit repair process.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by filling out your personal information, including your name, current address, and social security number. Make sure all details match the documentation you will provide.

- Include your spouse's information if applicable, such as their name and social security number. Remember, separate documentation is needed for both partners.

- Attach necessary documents such as a utility bill or driver's license to verify your current address, as well as proof of your social security number. Ensure these are in the correct formats as specified.

- Input details regarding your previous addresses if required. This ensures a comprehensive overview for the credit bureaus.

- If prompted, provide a retainer check or fill out the credit card authorization form for payment, ensuring that all financial details are accurate.

- Review all information entered carefully to confirm accuracy and completeness before proceeding.

- Once you have completed the form and checked all information, save your changes. You may print or download the completed form for your records.

- Share any correspondence or additional documents as instructed, ensuring to maintain copies for your own reference.

Start filling out your Your Own Credit Repair Business Form online today and take the first step towards credit restoration.

What is a credit repair business? Credit repair businesses are fully managed services that assist consumers in raising their credit score or helping them qualify for credit. Your clients will come to you with bad credit, and your goal is to help them improve it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.