Loading

Get Series 1992 Nontaxable Certificate Type 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Series 1992 Nontaxable Certificate Type 9 online

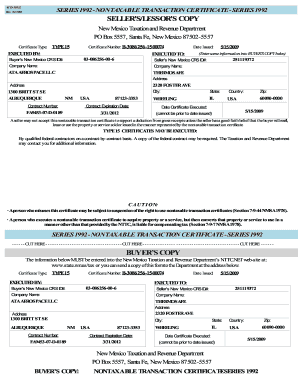

The Series 1992 Nontaxable Certificate Type 9 is a crucial document for conducting nontaxable transactions within New Mexico. This guide will provide you with clear instructions on how to accurately fill out the form online, ensuring that you understand each component and its importance.

Follow the steps to fill out the Series 1992 Nontaxable Certificate Type 9 online successfully.

- Click the ‘Get Form’ button to obtain the Series 1992 Nontaxable Certificate Type 9. This action will open the form in your online document editor.

- Enter the Certificate Type at the top of the form. Ensure you select 'TYPE 15' as this is specific to certain nontaxable transactions.

- Provide the Certificate Number in the designated field. This number is usually assigned by the Taxation and Revenue Department and must be filled out accurately.

- In the section labeled 'Executed By', enter your name or the name of the authorized individual executing the certificate.

- Fill out the 'Executed To' section with the recipient's information, including their New Mexico CRS ID number.

- In the fields marked 'Company Name', enter the names for both the seller and the buyer, ensuring that they are correctly typed as per their official registration.

- Provide the addresses for both the seller and the buyer clearly. Include the street address, city, state, and zip code.

- Detail the Contract Number and Contract Expiration Date in the respective fields, which helps define the scope and validity of the contract.

- In the field for 'Date Certificate Executed', enter the date you are filling out the form, ensuring it does not precede the date issued.

- Review all the entered information for accuracy. After ensuring everything is correct, you may save changes, download, print, or share the completed form as needed.

Take the next steps to complete your Series 1992 Nontaxable Certificate Type 9 online today.

New Mexico imposes a tax on the net income of every resident and on the net income of every nonresident employed or engaged in business in, into or from this state or deriving any income from any property or employment within this state. The personal income tax is filed using Form PIT-1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.