Loading

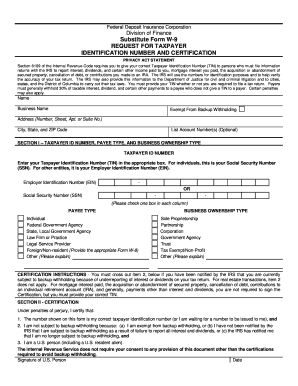

Get Fdic 4531/10, Substitute Form W-9, Request For Taxpayer ... - Print W9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FDIC 4531/10, Substitute Form W-9, Request For Taxpayer Identification Number online

Filling out the FDIC 4531/10, also known as the Substitute Form W-9, is essential for providing your taxpayer identification information accurately. This guide will help you navigate each section of the form, ensuring you complete it correctly and effectively.

Follow the steps to fill out the FDIC 4531/10 form with ease.

- Click ‘Get Form’ button to access the FDIC 4531/10 form in order to begin your process.

- Enter your name in the designated field. If you are filling out this form for a business, include the business name in the appropriate section.

- Provide your address, including the number, street, apartment or suite number, city, state, and ZIP code.

- If applicable, list any account numbers. This step is optional.

- In Section I, enter your Taxpayer Identification Number (TIN). For individuals, this will be your Social Security Number (SSN); for other entities, use your Employer Identification Number (EIN).

- Select your payee type by checking the appropriate box that applies to your situation: individual, federal government agency, state or local government agency, law firm, or other.

- Indicate the business ownership type by checking the relevant option: sole proprietorship, partnership, corporation, government agency, trust, or other.

- In the certification section, affirm that the information provided is accurate. Remember to cross out item 2 if you have been notified by the IRS about backup withholding.

- Sign and date the form where indicated. Ensure your name is printed clearly below your signature.

- Finally, save the completed document; you can download, print, or share it as needed.

Complete your FDIC 4531/10 form online today for a hassle-free submission!

The W-9 and W-4 forms may use e-signatures and the IRS rules around them are reasonable. ... Recipients of 1099 and W-2s must explicitly consent to receive their forms electronically, which does not require an e-signature, but does require a record of consent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.