Loading

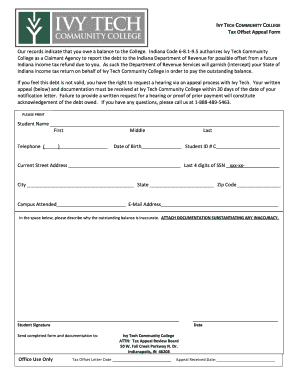

Get Ivy Tech Tax Offset Getting Money Back Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ivy Tech Tax Offset Getting Money Back Form online

This guide provides clear, step-by-step instructions for filling out the Ivy Tech Tax Offset Getting Money Back Form online. By following these steps, you can ensure your appeal is submitted accurately and efficiently.

Follow the steps to complete your Ivy Tech Tax Offset Getting Money Back Form online.

- Click ‘Get Form’ button to access and open the Ivy Tech Tax Offset Getting Money Back Form in an online editor.

- Enter your name in the designated field, ensuring to include your first name, middle name (if applicable), and last name.

- Provide your contact information by entering your telephone number.

- Fill in your date of birth in the specified format.

- Input your Student ID number in the given section, ensuring accuracy.

- Complete your current street address, confirming all details are correct.

- Specify your city, state, and zip code in the appropriate fields.

- Indicate the campus you attended in the provided space.

- Enter your email address, ensuring it is current and accessible.

- In the text area provided, clearly describe why you believe the outstanding balance is inaccurate and attach any supporting documentation.

- Sign the form in the provided space to confirm your appeal.

- Enter the date of your signature.

- After completing the form, save any changes made. You can then choose to download, print, or share the form as needed.

Submit your Ivy Tech Tax Offset Getting Money Back Form online today to ensure your appeal is processed swiftly.

From the end of the second week to the end of the week marking the completion of 75% of the course, a student may withdraw from a course online using MyIvy or by filing a change of enrollment form at the Registrar's Office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.