Loading

Get Mandatory Forbearance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mandatory Forbearance Form online

This guide provides comprehensive instructions on how to complete the Mandatory Forbearance Form online. Following these steps will help you ensure that your form is filled out accurately and submitted correctly.

Follow the steps to fill out the form online effectively.

- Press the ‘Get Form’ button to access the Mandatory Forbearance Form and open it in your preferred editing tool.

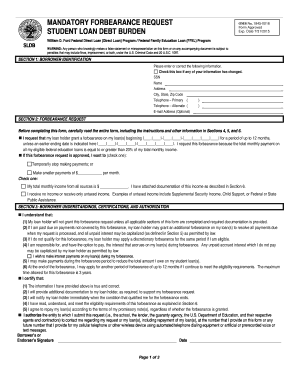

- In Section 1, enter your personal identification details. Ensure that your social security number, name, address, and contact information are accurate. If any information has changed, check the corresponding box.

- Proceed to Section 2 to submit your forbearance request. Specify the forbearance start date and duration, and check the appropriate options for your payment preferences and income status. Remember to attach necessary documentation.

- In Section 3, read the borrower's understandings and certifications carefully. Confirm your understanding by signing and dating the section.

- Review the instructions in Section 4 to ensure all entries are legible and correctly formatted, particularly for dates. Make sure necessary documentation is included as indicated.

- If needed, clarify any terms in Section 5, especially the impact of capitalization on your loan.

- Check Section 6 for eligibility requirements to confirm that you meet the criteria for submitting this forbearance request.

- Finally, return the completed form along with all required documents to the address provided in Section 7. You may also choose to save changes, download, print, or share the completed form for your records.

Take control of your student loan management and fill out your Mandatory Forbearance Form online today.

Forbearance is when your mortgage servicer or lender allows you to temporarily pay your mortgage at a lower payment or pause paying your mortgage. ... You will have to repay any missed or reduced payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.