Get Transfer On Death Registration (tod) Account Application ... - Invesco

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Transfer On Death Registration (TOD) Account Application - Invesco online

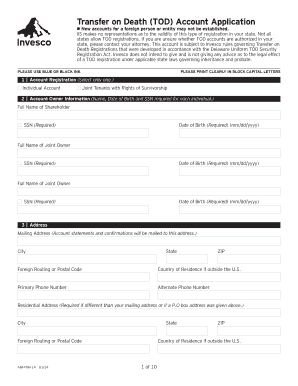

Filling out the Transfer On Death Registration (TOD) Account Application allows users to designate beneficiaries for their investment accounts, ensuring a smooth transfer of assets upon their passing. This guide will provide clear, step-by-step instructions tailored for users of all experience levels.

Follow the steps to complete the TOD account application online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Select the account registration type by choosing either 'Individual Account' or 'Joint Tenants with Rights of Survivorship'. This selection defines how ownership is structured.

- Fill out the account owner information for all individuals associated with the account. Provide full names, social security numbers, and dates of birth in the required fields.

- Complete the address section, including both mailing and residential addresses. Ensure accuracy as all statements and confirmations are sent to the mailing address provided.

- Designate your primary and contingent beneficiaries by including their full names, social security numbers or taxpayer identification numbers, and the percentage of the account each will receive upon your passing.

- Indicate whether you wish to receive confirmations and reports electronically by providing your email address, and select the documents you want to receive online.

- Fill out the investment instructions, specifying your method of investment (e.g., check or purchase through a financial advisor) and listing the funds you want to invest in.

- Choose how to handle dividends and capital gains—either reinvest them, send in cash, or direct them to a specified third party.

- Complete the telephone transaction options, indicating whether you authorize telephone exchanges, purchases, or redemptions.

- Review the signature section. All account owners must sign, dating the document appropriately, and confirm they meet all legal requirements.

- If applicable, complete the systematic options for automatic purchases or redemptions of funds, including frequency and amount.

- Attach any necessary documents, such as voided checks, to facilitate banking transactions.

- Check the mailing instructions, ensuring all required fields have been completed before submitting the application. Send it to the indicated physical addresses for direct or overnight mail.

Complete your Transfer On Death Registration (TOD) Account Application online today to ensure your assets are transferred according to your wishes.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia, ...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.