Loading

Get Pdf Filler Business Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Pdf Filler Business Payroll online

Filling out the Pdf Filler Business Payroll form effectively ensures accurate processing of employee payroll details. This guide provides clear and straightforward steps to help users navigate each section seamlessly.

Follow the steps to fill out the Pdf Filler Business Payroll online.

- Click ‘Get Form’ button to retrieve the form and open it for editing.

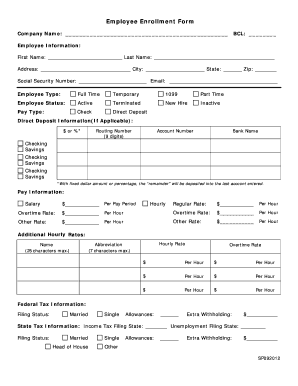

- Begin by entering the company name in the designated space at the top of the form. This identifies the organization associated with the payroll information.

- Fill in the Business Communication Line (BCL) field with the appropriate identifier.

- In the Employee Information section, input the employee's first and last name, followed by their address, city, state, and zip code.

- Provide the employee's Social Security Number and email address for contact purposes.

- Select the relevant Employee Type by marking the appropriate checkbox: Full Time, Temporary, 1099, or Part Time.

- Indicate the Employee Status by choosing one option: Active, Terminated, New Hire, or Inactive.

- Specify the Pay Type by selecting either Check or Direct Deposit. If choosing Direct Deposit, complete the Routing Number (9 digits), Account Number, and Bank Name fields.

- In the Pay Information area, indicate the Salary or Hourly rate. If salaried, enter the amount per pay period; if hourly, specify the Regular Rate and Overtime Rate.

- If applicable, list any Additional Hourly Rates with names, hourly rates, and corresponding abbreviations.

- Complete the Federal Tax Information section by selecting Filing Status and entering Allowances and any Extra Withholding amounts.

- Fill out the State Tax Information, including Income Tax Filing State, Unemployment Filing State, Filing Status, Allowances, and Extra Withholding.

- If applicable, add any Deductions such as Medical, Dental, Simple IRA, or 401K including names and amounts per pay period.

- If applicable, provide any Earnings such as Auto Allowance or Fringe Benefit, including names and amounts per pay period.

- Review all entered information for accuracy and completeness.

- Once satisfied, proceed to save changes, download a copy, print the completed form, or share it as needed.

Complete your payroll details online today for efficient management of employee compensation.

5 Steps to Create Payroll Forms Step 1: Provide Employee's Information. Collect some information about each employee. ... Step 2: State the Holidays or Leaves Taken By the Employees. ... Step 3: Lay Down the Salaries and Wages. ... Step 4: Mention the Deductions. ... Step 5: Describe the Net and Gross Pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.