Loading

Get Dr 501rvsh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 501rvsh online

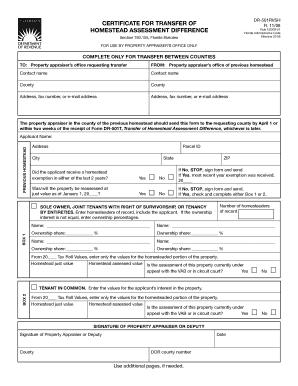

Filling out the Dr 501rvsh form online is an important step for transferring homestead assessment differences between counties in Florida. This guide provides clear and supportive instructions to help users navigate the form easily and accurately.

Follow the steps to complete the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the contact name, county, and address information for the property appraiser’s office requesting the transfer.

- Next, provide details for the previous homestead, including the applicant's name, address, parcel ID, city, state, and ZIP code.

- Indicate if the applicant received a homestead exemption in either of the last two years by selecting 'Yes' or 'No'. If 'No', STOP here, sign the form, and send it.

- Answer if the property will be reassessed at just value as of January 1 of the applicable year. If 'No', STOP here, sign the form, and send it. If 'Yes', indicate the most recent year the exemption was received.

- Complete either Box 1 or Box 2, depending on the ownership structure. For Box 1, list the names and ownership shares for sole owners or joint tenants. For Box 2, provide the values specific to the applicant's interest as a tenant in common.

- Input the homestead just value and homestead assessed value from the applicable tax roll values for the property.

- Indicate if the assessment of this property is currently under appeal with the Value Adjustment Board (VAB) or in circuit court by selecting 'Yes' or 'No'.

- Finally, the property appraiser or deputy should sign the form, provide their county, date, and DOR county number.

- Review the form for accuracy. Once complete, users can save changes, download, print, or share the form as needed.

Complete your Dr 501rvsh form online today to ensure a smooth transfer process!

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.