Loading

Get Form W-2 Wage And Tax Statement - Irs.gov - Internal Revenue ... - Apps Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-2 Wage And Tax Statement - IRS.gov online

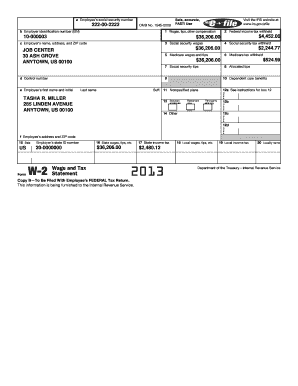

Filling out the Form W-2 Wage and Tax Statement is essential for reporting an employee's wages and the taxes withheld during the year. This guide will help you navigate the sections and fields of the form, ensuring accurate completion for your tax filings.

Follow the steps to complete the W-2 form accurately.

- Press the ‘Get Form’ button to access the W-2 form and open it in your editing tool.

- In box a, enter the employee's social security number. Ensure that it is accurate to avoid complications with tax returns.

- In box b, fill in the employer identification number (EIN), which is crucial for identifying the employer if tax issues arise.

- Under section c, enter the employer's name, complete address, and ZIP code to provide proper identification.

- In box 1, report the total wages, tips, and other compensation paid to the employee during the year.

- In box 2, input the federal income tax withheld from earnings throughout the year.

- Fill in box 3 for social security wages, which may differ from the total wages due to certain deductions.

- In box 4, document the total social security tax withheld from the employee's earnings.

- In boxes 5 and 6, respectively, provide the Medicare wages and the taxes withheld to ensure the correct deductions are reflected.

- If applicable, complete boxes 10 through 14 to report any dependent care benefits and other relevant information about retirement plans or sick pay.

- For state-related information, fill in boxes 15 through 20 detailing state wages and taxes withheld.

- After all sections are completed, review the form for accuracy before saving your changes, downloading, printing, or sharing the finalized W-2.

Complete your W-2 form accurately and securely by accessing it online.

The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3. Employers must file both W-2 and W-3 forms with the Social Security Administration by January 31 of every year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.