Loading

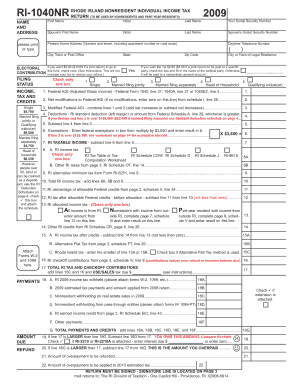

Get (to Be Used By Nonresidents And Part-year Residents) Name - Tax State Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (TO BE USED BY NONRESIDENTS AND PART-YEAR RESIDENTS) NAME - Tax State Ri online

This guide provides a comprehensive overview of filling out the (TO BE USED BY NONRESIDENTS AND PART-YEAR RESIDENTS) NAME - Tax State Ri online. It aims to assist users, regardless of their prior experience, in navigating each section of the tax form efficiently.

Follow the steps to successfully complete your tax form.

- Click the ‘Get Form’ button to access the tax form and open it for editing.

- Begin by entering your name and address details. Write your first name, middle initial, last name, and your Social Security number in the designated fields.

- If applicable, provide information for your spouse, including their name and Social Security number.

- Input your current residential address, including the street, city, and state. Make sure all details are correct and match your official documents.

- Select your filing status by checking the appropriate box. Review the income thresholds based on your status to determine if any additional deductions apply.

- Proceed to the section regarding your income. Enter your Federal Adjusted Gross Income as outlined on the Federal Form 1040, and make any necessary modifications.

- Continue by calculating your deductions. Choose either the RI standard deduction or your itemized deductions based on Federal Schedule A.

- Follow the steps to calculate your exemptions and taxable income, ensuring you apply any necessary formulas correctly.

- Complete the tax section by selecting the applicable tax computation methods and adding up any additional taxes as instructed.

- Review any available credits and input your amounts from the relevant schedules, while ensuring accuracy to maximize your refund or minimize owed amounts.

- After filling out all sections, thoroughly review the form for completeness and accuracy.

- Finally, you can save your changes, download the completed form, print it out, or share it according to your needs.

Get started and complete your tax form online today for a hassle-free filing experience.

If you earn income in one state while living in another, you will need to file a tax return in your resident state reporting all income you earn, no matter the location. You might also be required to file a state tax return in your state of employment or any state where you have a source of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.